Approved by the State Council of Chinese government, China-Belgium Direct Equity Investment Fund (CBDEIF or The Fund), was officially established on November 18, 2004 via raising 100 million Euros as registered capital via subscription from many parties from China and Belgium.

History

In March 2002, the two governments signed the memorandum on the establishment of China-Belgium Direct Equity Investment Fund. China’s Ministry of Finance, the Ministry of Public Enterprises, Communication and Participation of the Belgium government, China’s Haitong Securities and Belgium’s Fortis Bank S.A./N.V. were the founding investors of the Fund.

In May 2004, the then Chinese Premier Wen Jia-Bao graced the signing ceremony of “The Charter of China-Belgium Direct Equity Investment Fund”, held in Brussels, Belgium, on his official state visit to the Kingdom of Belgium.

CBDEIF Shareholders (By end 2015)

|

Shareholders |

Investment (Mln Yuan) |

Subscription Date(Y-M-D) |

|

Ministry of Finance (PRC) |

8.5 |

2003-9-24 |

|

Belgian government (via Ministry of Public Enterprises, Communication and Participation) |

8.5 |

2003-7-24 |

|

National Council for Social Security fund (PRC) |

15 |

2004-7-20 |

|

CDB Capital Co., Ltd. |

15 |

2004-9-6 |

|

China Banknote Printing and Minting Corporation |

13 |

2004-7-21 |

|

Haitong Securities Co., Ltd. |

10 |

2003-9-24 |

|

Fortis Bank S.A./N.V.(In October 2008, 75 percent of its stake was sold to BNP Paribas and now its commercial name is reportedly to be BNP Paribas Fortis.) |

10 |

2003-7-6 |

|

State Development & Investment Corporation |

10 |

2004-8-26 |

|

Guangdong Strong (Group) Co., Ltd. |

10 |

2004-8-9 |

(Source:http://gsxt.saic.gov.cn/)

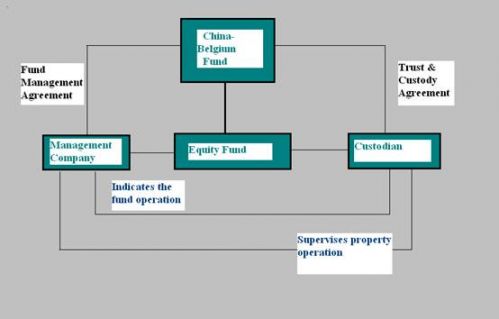

Structure of CBDEIF Fund Management

On January 18, 2015, the CBDEIF, Haitong-Fortis Private Equity Fund Management Company and Shanghai Pudong Development Bank signed fund management agreement and trust & custody agreement, indicating the start of fund operation.

Fund Manager

Haitong-Fortis Private Equity Fund Management Co., Ltd.

Custodian of Assets of the Fund

SPD Bank

Target Companies

Different from VC which usually invests in incubation stage and start-up state companies, CBDEIF mostly invests in growth stage companies.

Projects that do not relate to Belgium:

Management Team

Experienced and responsible team

Prospective

Fast growing prospect and long term strategic value

Competitive Advantage

Advanced investment strategy

Large market share and strong position

Profitable capacity and property quality

IPO Potential

IPO potential or purchase by other shareholders

Belgium related projects:

Belgium related projects: this type of projects are those Belgium companies established in China, which are entirely or partly held by Belgian, or those companies that are currently, or going to be, provided with equipments or copyrights by Belgium enterprises.

According to the fund management agreement, CBDEIF invests no less than 15 percent of its total capital in Belgium related projects.

Project Investment Requirements:

For each of these projects, a minimum investment of 500,000 Euros is set.

An internal rate of return (IRR) of no less than 15 percent.

Investment Method, Size, Equity Share and Horizon

Investment Method

Private placement (including co-investment)

Investment Size

Generally invests 20 million -180 million yuan in an individual target company

Equity Share

Typically takes an equity share between 0 percent and 49 percent

Time Horizon

Normally ranges from 3 to 7 years for individual companies

Investment Status (March 2012)

The Fund has invested in 35 enterprises, which scatter in 12 provinces or regions.

The Fund has invested 1.251 billion yuan roughly.

There are 12 listed companies held by The Fund. The whole market value of the Fund (including listed, existing, and other investment principles) is around 5.360 billion yuan.

Investment Decisions

Haitong-Fortis Private Equity Fund Management Co., Ltd. - manager of the Fund (hereinafter referred to as the Company), has established its Investment Committee, which makes decisions on individual investments that do not exceed 5 million Euros (or Renminbi equivalent) in size. For those individual investments that exceed 5 million Euros (or Renminbi equivalent) in size, investment decisions require approval by the board of the Fund.

From initial screening to completing a transaction, a typical investment process takes about three months. This time could be longer than three months if the transaction in question requires the approval of the board of the Fund.

The Fund’s decision making is based on the principles such as rational decision, effective risk control and high efficiency, and its deal execution process consists of initial screening, due diligence and evaluation, transaction negotiation, investment decision, project management and exit.

Screening and Project Initiation

On the basis of preliminary screening and investigation, The Company will conduct an initiation of projects that match The Fund’s criteria in terms of investment value and feasibility.

Due Diligence and Evaluation

For the initiated projects, a project team is formed to undertake due diligence that contains areas such as company background, management team, industry background, core competence, operations, finance, legal issues, business plan of fund expenditure.

The Company sources specialists in various industries for professional consultation according to the need of the project, while employing accountants, lawyers, valuators in the process of due diligence of target projects.

Del Negotiation

The Fund expects to present in the board of the target company in order for the participation in the key decisions during the operations of the target company. And the Fund hopes to reach an agreement with the company concerning the liquidation arrangement of the shares of The Fund.

Investment Decision

The Company’s Committee of Investment Decision is responsible for the formation of investment principles, project screening, project management and investment decisions. In case that the amount of an individual investment exceeds 5 million Euros, the final decision will be made by the board of the Fund on the basis of the Investment Plan submitted by the Company.

Project Management

When the investment has been completed, the Fund will be participating in the key decisions of the invested company according to periodically collected information on the financial and operational performance, risk alert system of the invested company.

Investment Exit

The Company will be planning and conducting the liquidation strategy based on the industrial status quo, macro-economic environment and the performance of the invested company. Potential exit will be realized through shares selling after IPO, purchase by other shareholders, MBO and buyback by the invested company.

Core Competence of the Fund

Promising fund shareholder background

Shareholders of the Fund are generally related to investment or credit financing with sound experience in investment management and strong teams of investment professionals. Shareholders of the Fund will have the possibility to co-invest in or provide with credit support to the portfolio company of The Fund.

Preeminent brand name

As the first private equity fund established under market practice in China, The Fund is serving as an example of the Chinese private equity fund industry and one of the most important bilateral co operations between the Chinese government and the Belgium government. The brand name of the Fund is going to significantly promote the public image and market recognition of the portfolio company, as well as to offer vigorous supports in areas such as business expansion, credit financing and IPO service.

Professional investment team

The backbone of the Company, an experienced and professional management team, is composed of talents with domestic and overseas backgrounds in finance, technology, investment and management, and valuable experience in capital market, project investment, corporate operations, accounting, auditing and law. The Fund is able to improve the shareholding structure, the corporate governance and the overall management of the portfolio company through active involvements in the management and key decisions by assuring better transparency and standardization.

Powerful capital source

With 100 million Euros, the Fund enhances the portfolio company’s capability of further financing by improving its capital structure and broadening the source of capital. And The Company is potentially raising further funds according to the growing needs of the market.

Advanced investment strategy

A close partnership with invested companies is one of the key factors that boost the win-win situation for both the Fund and portfolio companies. The Fund and the Company will be providing potential assistance to invested companies regarding information on technology, product, market and policies, as well as introduction of equipments, technology and management through governmental cooperation and global market channels. Other assistance, including further financing and IPO, will be achieved based on the concept of resource sharing and co-development.

A single purchase

A single purchase